The purpose of this blog is to provide you, our clients, with detailed information regarding the Luxury Home Tax, formally identified as the “Solidarity Tax to Strengthen Housing Programs”

1. What is the Luxury Home Tax?

The luxury home tax is levied on residential properties with a construction value exceeding $ 216,500.00 (fixed or permanent installations), regardless of its regular, occasional or recreational use. There is no distinction within the law regarding primary or vacation homes (please see Section 6 for further reference). The proceeds are collected by the General Tax Department (known in Spanish as the “Dirección General de Tributación”) and are used to finance public programs to provide housing for families under the poverty line.

The following are exempt from the Luxury Home Tax:

- Properties destined for agricultural or commercial purposes.

- properties with a construction value of less than $ 216,500.00.

- Raw land.

- Properties owned by non-profit organizations, churches or the government.

2. Tax Base

The Luxury Home Tax is levied on houses with a construction value over $216,500.00. The threshold value is based on elements such as the materials, system, and age of the construction (it does not consider the value of the land). However, if the construction value exceeds said threshold, the total value of the property (including the value of the land) will be subject to taxation based on the rates described in Section 3.

To determine the construction value of your Property, and the obligation to declare and pay the tax, you must hire a licensed appraiser. Please keep in mind that the appraisal is done pursuant to the technical criteria established by the General Tax Department, and not the standard market practices. Upon request, your lawyer may outsource an appraisal on your behalf and at your behest. The value is afterward declared to the General Tax Department through a sworn statement.

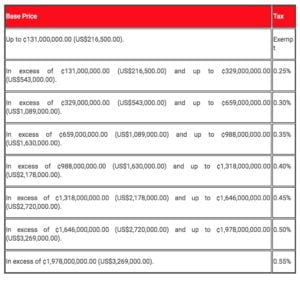

3. Rates

The tax percentage will be based on the following rates:

4. Payment

The Client must normally declare the value of the property before the General Tax Department prior to January 15th every three years, and pay the tax on or before January 15th. However, this year the term has been extended until January 25th. Your lawyer may record the Client as an active taxpayer and assess the corresponding tax.

5. Penalties for Non-Compliance

The following penalties will be applied to owners that fail to comply with the Luxury Home Tax:

- If there is a difference exceeding 10% between the amount declared by the Client and what the General Tax Department considers applicable, the Client will be sanctioned with a penalty equal to 5 times the tax amount that was not declared and paid.

- If the Client does not submit the declaration, it will be sanctioned with a penalty of up to 10 times the tax that had to be paid.

6. Vacation Rentals

As explained above, the Luxury Home Tax is levied on residential properties with a construction value over $216,500.00. However, recent interpretation from the General Tax Department has established that vacation home rentals are not considered a commercial activity capable of exempting the property from the tax. The basis for this interpretation is that the underlying use made by the vacation renter is residential and the property has a “true residential purpose”.

![]()

It is recommended to conduct an appraisal and determine the value of your construction, even though you are not using your property as a residential home, to determine if you are subject to the Luxury Home Tax. You are welcome to reach out to us for an opinion and/or referral for an appraiser.

Please keep in mind that there is a new Tax Law being discussed at the Costa Rican Congress, that will scrutinize possible tax evasion and enhance all current tax collection procedures. Please review this information and do not hesitate to contact your lawyer if you have any questions, comments or require any additional information.

This is a general summary of the Luxury Home Tax, therefore, there are specific cases where other aspects may apply, that need to be addressed on a case-by-case basis.